QuickBooks® Real-time Reconciliation

The Best Real-time Payments Processing in QuickBooks®

Today Payments is an Authorized Developer of Intuit offering a highly robust app that supports both QuickBooks’ desktop and online customers, provide merchants with the tools they need so they can focus more time on their customers and businesses, and less time on data entry. "Our Integrated payment solutions can save a typical small business owner more than 180 hours each year"

"Our Integrated payment solutions can save a typical small business owner more than 180 hours each year"See

the features

QuickBooks® ACH, Cards, FedNow and Real-Time Payments

- Payment processing for all QuickBooks desktop, Pro, Premier, Enterprise and also QBO QuickBooks Online Our software is designed for simplicity and ease-of-use.

- ~ Automate Account Receivable Collection

- ~ Automate Account Payable Payments

- ~ One-time and Recurring Debits / Credits

Secure QB Plugin payment processing through QuickBooks ® specializes in the origination of moving money electronically.

Ask about our special:

Request for Payments

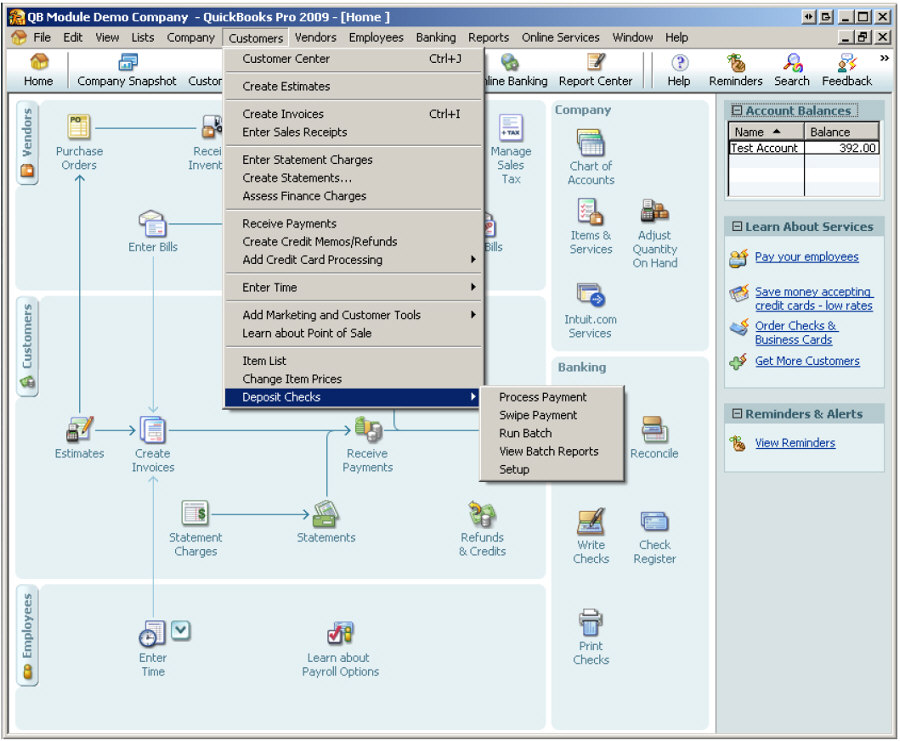

Performing real-time payments reconciliation for RTP (Real-Time Payments) and FedNow and syncing the data into QuickBooks Online (QBO) involves several steps. Here's a general guide to help you through the process:

1. Understand Real-Time Payments Reconciliation:

- Transaction Monitoring: Monitor your RTP and FedNow transactions in real time. This may involve using APIs provided by the payment platforms to fetch transaction details instantly.

- Reconciliation Rules: Establish reconciliation rules based on your business processes. This includes matching transaction amounts, dates, and other relevant details.

2. Set Up Spreadsheets for Reconciliation:

- Data Structure: Design your spreadsheet to accommodate necessary details such as transaction ID, amount, date, payer/payee information, and any custom fields relevant to your reconciliation process.

- Automation: Utilize formulas or scripts within your spreadsheet to automate the reconciliation process where possible. For example, you can use VLOOKUP or INDEX-MATCH functions to match transaction details.

3. Syncing with QuickBooks Online:

- Exporting Data: Export relevant data from your reconciliation spreadsheet. This may include a summary of matched transactions, unmatched transactions, and any discrepancies.

- CSV Format: Ensure your data is in a format compatible with QBO. Usually, CSV (Comma-Separated Values) is a common format for importing data into accounting software.

- Importing into QBO: In QuickBooks Online, navigate to the appropriate section (e.g., Banking) where you can import transactions. Use the import functionality to upload your CSV file.

- Mapping Fields: During the import process, map the fields in your CSV file to the corresponding fields in QBO. This ensures that the data is correctly interpreted and integrated into your accounting records.

4. Regular Reconciliation Process:

- Frequency: Establish a regular schedule for performing reconciliation. Depending on your business volume, this could be daily, weekly, or monthly.

- Exception Handling: Develop a process for handling exceptions. If there are discrepancies or unmatched transactions, determine how you will investigate and resolve these issues.

5. Security and Compliance:

- Secure Data Handling: Ensure that you handle sensitive financial data securely. Use secure connections and protocols when accessing APIs or importing/exporting data.

- Compliance: Adhere to relevant regulations and compliance standards when handling financial data and reconciling transactions.

6. Automation Tools and Integration:

- Consider Integration Solutions: Explore integration solutions or tools that may streamline the reconciliation process. Some accounting software and third-party tools offer automation features for syncing payment data.

- API Integration: If feasible, explore the possibility of direct API integration between your payment platforms, reconciliation tools, and QBO for a more seamless process.

7. Testing and Validation:

- Test Scenarios: Before implementing the entire process, conduct thorough testing with sample data to ensure that the reconciliation and syncing processes work as expected.

- Validation Checks: Implement validation checks to catch errors or discrepancies early in the process.

8. Documentation:

- Document Processes: Maintain detailed documentation for your reconciliation processes, including steps, formulas used, and any troubleshooting procedures.

- Audit Trail: Keep an audit trail of changes made during the reconciliation process for accountability and transparency.

By following these steps, you can establish a systematic process for real-time payments reconciliation with RTP and FedNow and seamlessly sync the data into QuickBooks Online using spreadsheets. Keep in mind that the specific details and tools may vary based on the APIs provided by your payment platforms and any specific requirements of your business.

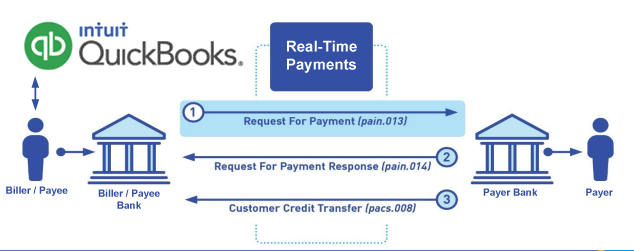

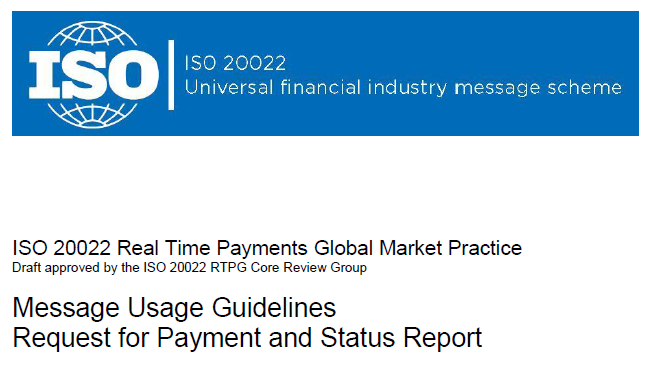

Call us, the .csv and or .xml Request for Payment (RfP) file you need while on your 1st phone call! We guarantee our reports work to your Bank and Credit Union. We were years ahead of competitors recognizing the benefits of RequestForPayment.com. We are not a Bank. Our function as a role as an "Accounting System" in Open Banking with Real-Time Payments to work with Billers to create the Request for Payment to upload the Biller's Bank online platform. U.S. Companies need help to learn the RfP message delivering their bank. Today Payments' ISO 20022 Payment Initiation (PAIN .013) show how to implement Create Real-Time Payments Request for Payment File up front delivering message from the Creditor (Payee) to it's bank. Most banks (FIs) will deliver the message Import and Batch files for their company depositors for both FedNow and Real-Time Payments (RtP). Once uploaded correctly, the Creditor's (Payee's) bank continuing through a "Payment Hub", will be the RtP Hub will be The Clearing House, with messaging to the Debtor's (Payer's) bank.

Our in-house QuickBooks payments experts are standing ready to help you make an informed decision to move your company's payment processing forward.

Pricing with our Request For Payment Professionals

1) Free ISO 20022 Request for Payment File Formats, for FedNow and Real-Time Payments (The Clearing House) .pdf for you manually create "Mandatory" (Mandatory data for completed file) fields, start at page 4, with "yellow" highlighting. $0.0 + No Support

2) We create .csv or .xml formatting using your Bank or Credit Union. Create Multiple Templates. Payer/Customer Routing Transit and Deposit Account Number may be required to import with your bank. You can upload or "key data" into our software for File Creation of "Mandatory" general file.

Fees = $57 monthly, including Support Fees and Batch Fee, Monthly Fee, User Fee, Additional Payment Method on "Hosted Payment Page" (Request for file with an HTML link per transaction to "Hosted Payment Page" with ancillary payment methods of FedNow, RTP, ACH, Cards and many more!) + $.03 per Transaction + 1% percentage on gross dollar file,

3) Payer Routing Transit and Deposit Account Number is NOT required to import with your bank. We add your URI for each separate Payer transaction.

Fees Above 2) plus $29 monthly additional QuickBooks Online "QBO" formatting, and "Hosted Payment Page" and WYSIWYG

4) Above 3) plus Create "Total" (over 600 Mandatory, Conditional & Optional fields of all ISO 20022 Pain .013) Price on quote.